If you are not redirected automatically, please click on the URL below.

ページが切り替わらない場合は、https://www.english.metro.tokyo.lg.jp/topをクリックしてください。

Please enable JavaScript to use the website of the Tokyo Metropolitan Government.

Main content starts here.

July 1, 2021

Office of the Governor for Policy Planning

Tokyo Metropolitan Government

Tokyo Financial Award, Financial Innovation Category:

Now Accepting Candidate in Finance!

As one project in the “Global Financial City: Tokyo” Vision, the Tokyo Metropolitan Government (TMG), following last year’s program will continue hosting the “Tokyo Financial Award.” TMG has been granting a prize to businesses who provide and develop innovative products and services that meet Tokyo citizens and businesspeople’s needs and challenges, as well as those who work to promote ESG investments*.

We have asked Tokyo residents and businesspeople about the daily needs and issues that they face in relation to financial services, and have created the themes listed below.

The selection process for the “Financial Innovation Category” will start from today. You are cordially invited to make your submission.

Additionally, we plan to start accepting candidate businesses for the “ESG Investment Category” from the middle of July.

* ESG (“Environmental, Social, Governance”) investment refers to investment decisions based on an institution’s proactive efforts in combating global warming, empowering women, selecting outside directors, etc.

1 Selection Themes

The Financial Innovation Category includes a total of 34 themes, divided among 6 general fields. We are looking for candidates who can propose solutions to these issues.

| Field | Themes (What customers want) |

|---|---|

| Deposits/Withdraws |

|

| Payments |

|

| Asset Management |

|

| Insurance |

|

| Financing |

|

| Others (Financial Service as a whole) |

|

2 Selection Details

| Eligible institutions | Domestic and international financial institutions that offer solutions to citizens and businesspeople’s needs and challenges and who are offering services in, or plan to offer services in, Tokyo. |

|---|---|

| Submission period | From: Thursday, July 1, 2021 To: Tuesday, August 31, 2021 |

| Number of award winners | 3 institutions |

| Rewards |

|

| How to apply | Please visit the Tokyo Financial Award website to apply *Please see submission guidelines for details(PDF:316KB) |

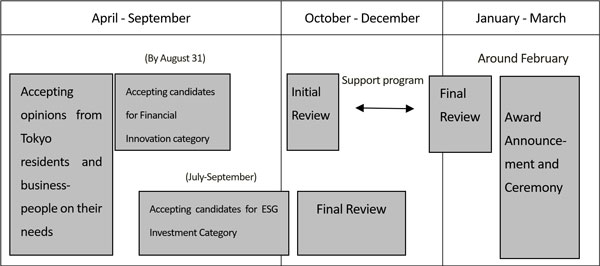

3 Schedule

※Please click here for the original Japanese article.

| Inquiries |

| Assigned Operations for Global Financial City Tokyo Strategic Projects Section, Strategic Projects Division Office of the Governor for Policy Planning Email: S0014701(at)section.metro.tokyo.jp * The above e-mail address has been arranged as an anti-spam measure. Please replace (at) with @. Phone: 03-5388-2144 |