If you are not redirected automatically, please click on the URL below.

ページが切り替わらない場合は、https://www.english.metro.tokyo.lg.jp/w/001-101-000054をクリックしてください。

Please enable JavaScript to use the website of the Tokyo Metropolitan Government.

Main content starts here.

Tokyo's Finances

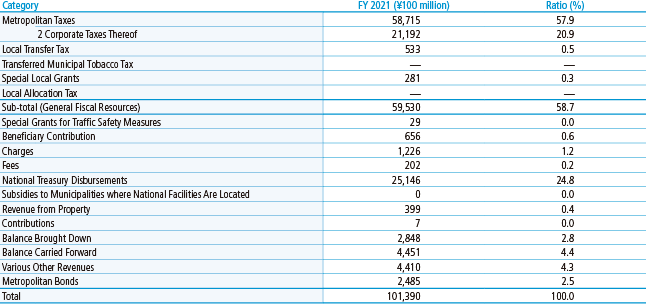

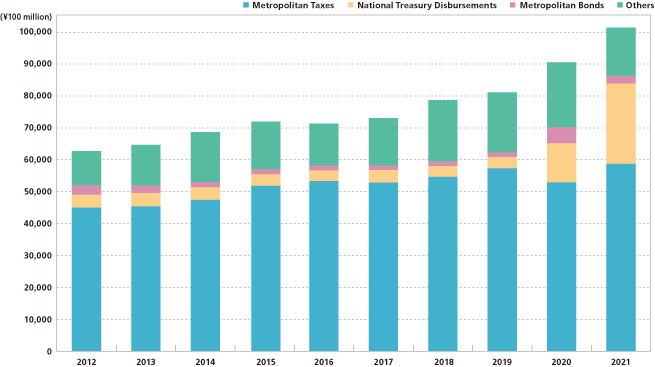

Revenue

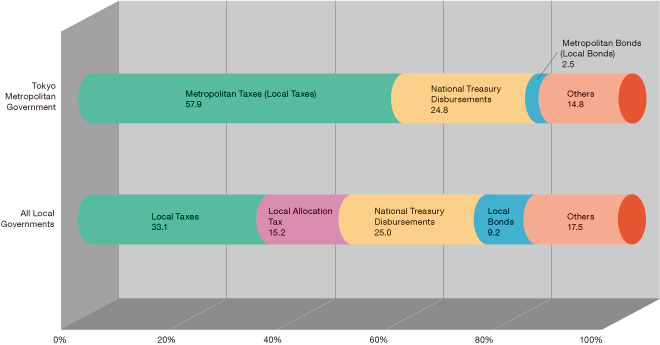

Metropolitan taxes accounted for the largest portion of the settled account for metropolitan revenue in fiscal 2021 at 57.9%. In light of the fact that local taxes accounted for just 33.1% of the total combined revenue of all local governments in fiscal 2021, the large share held by local taxes in Tokyo’s revenues is a feature of metropolitan finances.

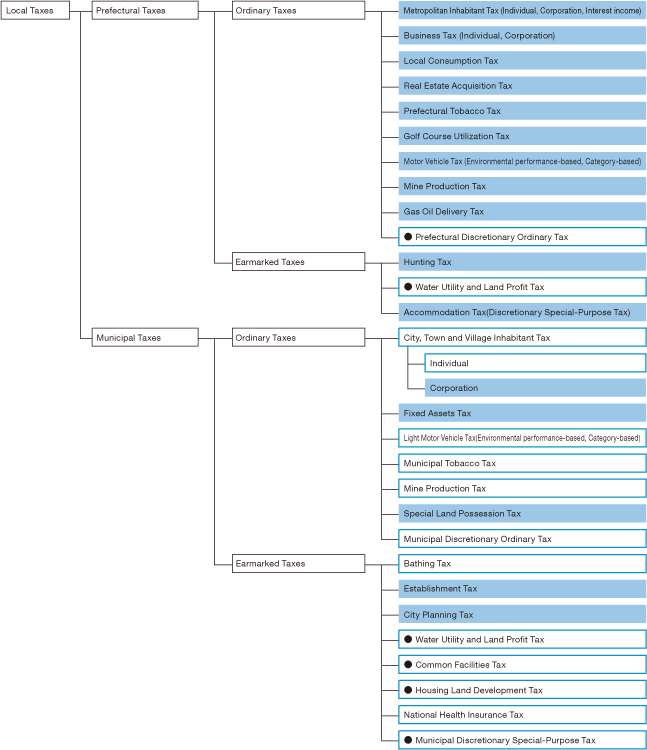

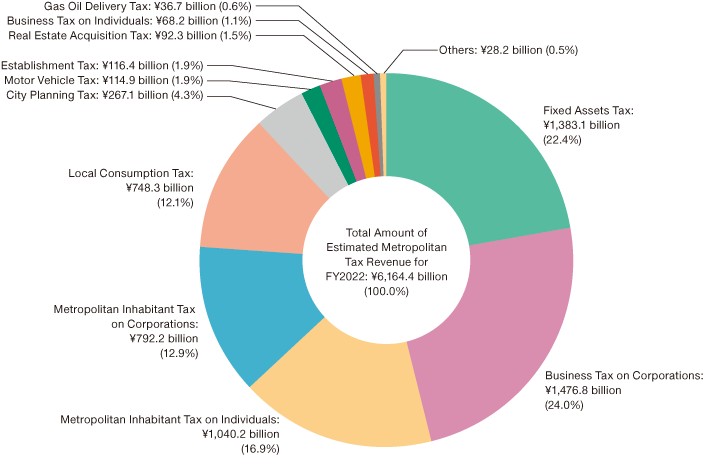

The metropolitan government levies 16 of the local taxes listed in the Local Tax System chart below. The largest proportion of total metropolitan tax revenue in fiscal 2021 came from the two corporate taxes of Corporate Business Tax and Corporate Inhabitant Tax (36.1%). This is followed by the Fixed Assets Tax and the City Planning Tax (26.8%).

There are several taxes levied by the metropolitan government in the 23 special wards, which in other prefectures are not levied by the prefectural authority but rather come under municipal taxes. These special measures are taken to cover the expenses of services provided by Tokyo, such as fire fighting and sewerage in the ward area, which are generally carried out by the municipality. Then, 55.1% of the combined total of revenues from municipal inhabitant tax on corporations, fixed assets tax, and special land possession tax, and the corporate business tax grant and special grant for fixed assets tax reduction compensation, is allocated to each of the wards to provide them with their own financial resources.

Regarding national treasury disbursements, in fiscal 2021, this category accounted for 25.0% of total local government finances and 24.8% of metropolitan finances.

Metropolitan bonds constitute an important financial resource for infrastructure development and urban renewal. To avoid a future increase of financial burdens, the metropolitan government is endeavoring to refrain from any undue reliance upon the flotation of metropolitan bonds, and to contain them within an appropriate degree.

Details of Tokyo Metropolitan Government Revenue

Details and Trends of Tokyo Metropolitan Government Revenue

Comparison of Revenue Breakdown

Tokyo Metropolitan Government: FY2021 Settlement of Accounts

All Local Governments: FY2021 Settlement of Accounts

Local Tax System (As of April 1, 2023)

Note 1: Municipal taxes in the sky blue box are metropolitan taxes in the 23 special wards.

● indicates that the tax is not levied in Tokyo Metropolis.

Note 2: Special Land Possession Tax has been suspended since fiscal 2003.

Breakdown of Metropolitan Tax Revenue for FY2022 (composition ratio)

Note 1: Figures shown have been rounded off. The total amount of the estimated tax revenue may not agree with the sum of the individual taxes.

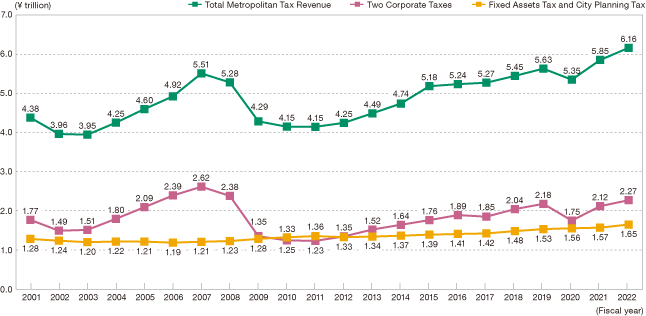

Metropolitan Tax Revenue Trends (2001–2022)

Expenditure

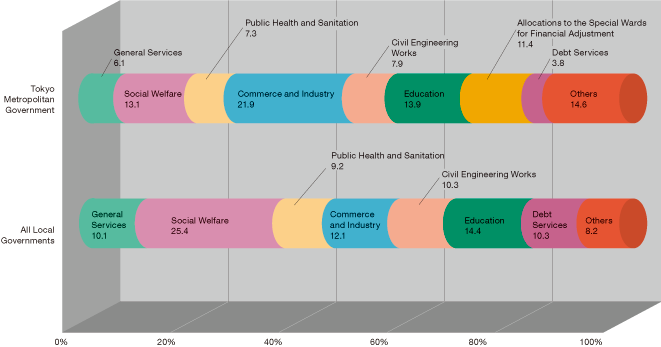

The expenditure of the metropolitan government has significant differences from the expenditure of other local authorities. First, Tokyo is responsible not only for administration at a prefectural level but also for a portion of the administrative services in the special-ward area, which elsewhere would be carried out at the municipal level.

Another important difference is the special ward financial adjustment allocations, an expenditure item found only in Tokyo. The special ward financial adjustment system aims to have financial resources related to the metropolitan administration fairly distributed between the metropolitan government and the 23 special wards, as well as to correct the imbalances between the 23 special wards in their fiscal strengths and ensure that they can provide an adequate level of public services.

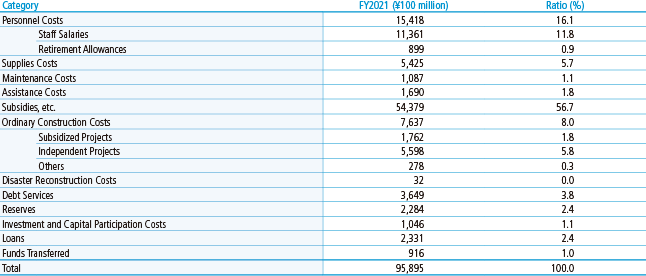

When expenditure is viewed by type, personnel expenses constituted approximately 20% of total expenditure in fiscal 2021; the majority of this is the staff salaries of the police and fire departments, schools and other personnel directly concerned with the lives of Tokyo's residents. Ordinary construction costs accounted for about 10% of total expenditure. These are the costs to build social infrastructure such as roads and bridges, and facilities including schools and social welfare facilities. In addition, subsidies and other expenditures, which include allocations to the special wards for financial adjustments and subsidies for facility operation costs, also made up a large proportion.

Introduction of a New Public Accounting System

Adding to the existing cash-basis accounting system, which corresponds to the budget system, in FY2006 the Tokyo Metropolitan Government (TMG) introduced double-entry bookkeeping and accrual-basis accounting standards that take into consideration characteristics particular to public administration. This was a first in Japan. Based on this financial accounting system unique to the metropolitan government, financial statements prepared in accordance with corporate accounting practices are released in the TMG Annual Financial Statements and other mediums.

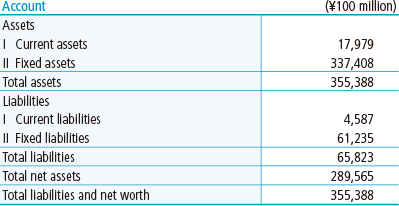

(1) Balance Sheet (FY2021)

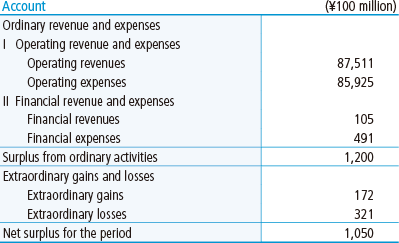

(2) Statement of Operating Costs (FY2021)

Note: Due to rounding of figures in the above tables, the totals may not correspond with the sum of the separate figures.

Challenges Facing Metropolitan Finances

Japan’s economy is expected to recover in this age of living with COVID, due in part to the effects of various policies, but future economic trends must continue to be watched closely. These include the risk of downward pressure put on Japan's economy through downtrends in foreign economies as global monetary tightening and other policies continue, as well as the impacts of rising prices and fluctuations in the financial and capital markets.

Metropolitan tax revenues form the core of Tokyo’s revenue, and a large share of those tax revenues come from corporations. This essentially makes the fiscal structure an unstable one that is easily swayed by economic trends. Although metropolitan tax revenues are trending upward due to a recovery in corporate earnings and other factors, the uncertainty of future economic trends makes it difficult to project at this time the future of Tokyo’s fiscal climate.

Amid such circumstances, the era is changing at an increasingly high speed, and it is no exaggeration to say that the greatest challenges since the end of WWII are being faced in all fields, including energy, population decline, food, and the economy. At what is now a turning point in history, Tokyo must squarely face these ordeals and by gathering the wisdom of the world and that of the entire Tokyo Metropolitan Government, it must boldly evolve into a city that creates new value.

The engine driving greater growth is none other than the power unleashed by having everyone play their own vibrant role in society through mutual understanding and respect. It is crucial to create a Tokyo where each individual can take center stage, such as by investing in children who shape the future and making Tokyo a diverse city where everybody can lead lives that are true to themselves.

In addition, as safety and security are at the foundation of all urban activities, it is essential to proactively implement measures from both hard and soft infrastructure to build a resilient and sustainable city by also taking into account disasters occurring in recent years from increasingly severe torrential rain and the challenges that have emerged from the new damage forecasts for a major earthquake directly hitting the Tokyo metropolitan area.

Furthermore, in order to leave a sustainable and beautiful planet to the future, Tokyo must take the lead in Japan to halve carbon emissions by 2030, and beyond that, to realize Zero Emission Tokyo. This includes making it mandatory to install photovoltaic systems in new small and medium-sized buildings such as houses, expanding the use of ZEVs, and creating a hydrogen society.

At the same time, not only is it necessary to implement initiatives to protect the daily lives of the people of Tokyo from soaring prices and other issues, and formulate full response to COVID by wielding experiences up to now, but it is also essential to promote policies to make Tokyo the world’s city of choice which is brimming with vitality, such as through nurturing startups that will generate green transformation, digital transformation, and other key trends in the global economy, creating attractive communities in the city center and waterfront areas, and letting the world know about the attractiveness of Tokyo, built upon the legacy of the Tokyo 2020 Games.

In light of these circumstances, the Tokyo Metropolitan Government will accelerate efforts to shape the future of Tokyo and advance the structural reform of the government based on Future Tokyo: Tokyo’s Long-Term Strategy and SHIN-TOSEI 3: Strategy for the Structural Reform of the TMG to Upgrade QOS (Version Up 2023), along with maintaining a resilient fiscal foundation through extensive implementation of wise spending, using ingenuity to reduce wasteful spending even more.

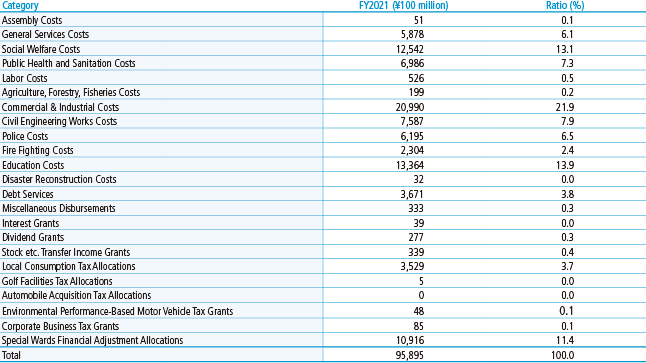

Details of Tokyo Metropolitan Government Expenditure (by Purpose)

Details of Tokyo Metropolitan Government Expenditure (by Type)

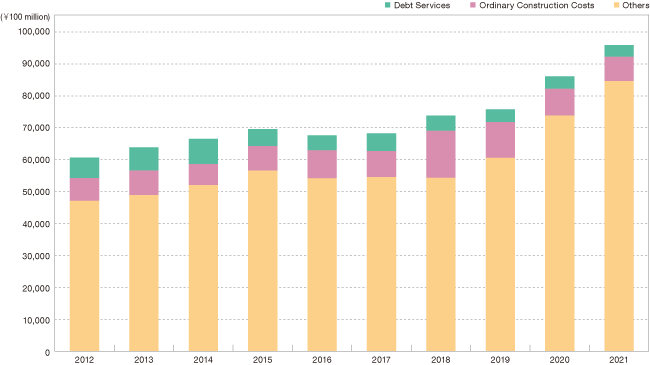

Details and Trends of Tokyo Metropolitan Government Expenditure

Expenditure Breakdown Comparison

Tokyo Metropolitan Government: FY2021 Settlement of Accounts

All Local Governments: FY2021 Settlement of Accounts